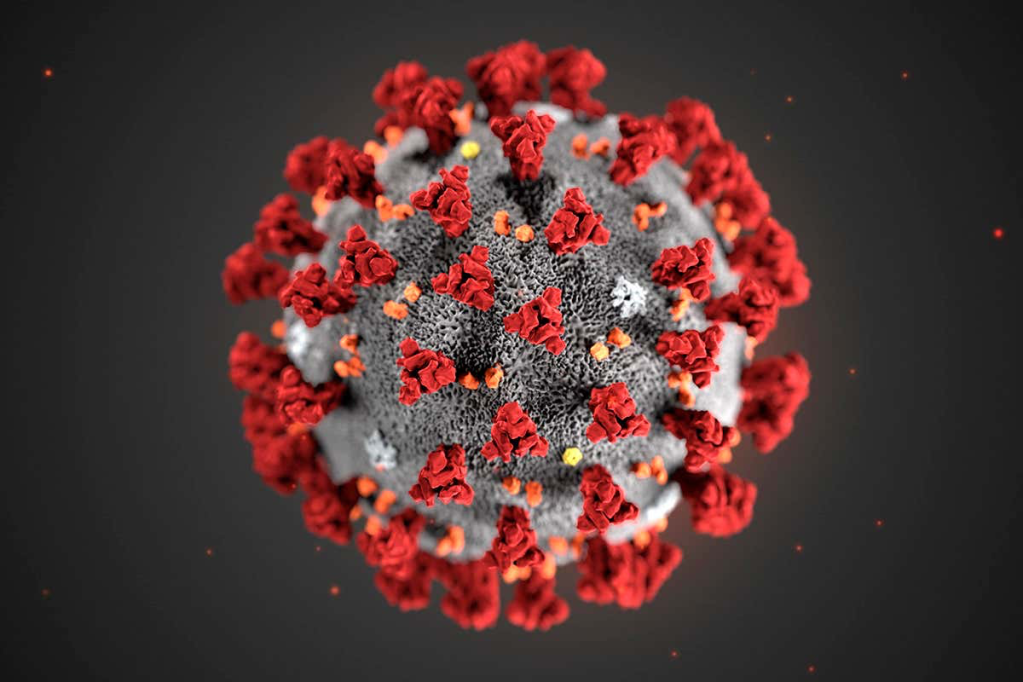

Society is faced with a pathogen that currently has no treatment and no vaccine.

We each have to realize how highly infectious this pathogen is even though people may not be showing symptoms that they are infected.

College-age youth, at least in the US, is demonstrating its collective stupidity, ignorance, and irresponsibility by gathering in large crowds in their Spring Break locations.

Each of us as individuals must commit to:

- ‘Flatten the curve’ so that our healthcare systems are not over-whelmed (causing healthcare providers to decide who lives and who dies)

- Marking time by adhering to the government-mandated rules in the States we live (which is never pleasant but is critically required) until a treatment or vaccine is available AND is provided to as many people as possible in each local, city, and state (or province).

State governments in the US are NOT over–reacting by locking down their States, closing businesses, and/or strongly suggesting citizens commit to ‘social distancing’.

Personally, I hold our Governor (of New Mexico) in very high regard because I respect her aggressive initiatives to ‘flatten the curve.’

Regarding my insurance industry:

- I absolutely do NOT want any P&C insurer, whether a specialty insurer or not, to pay one dime for Business Interruption claims if the contract they crafted (terms, conditions, and restrictions) and priced states that pathogen / pandemic / or virus claims are excluded.

- I absolutely do NOT want any P&C insurer to give in to jaw-boning or any other kind of political pressure to pay any claim, whether for Business Interruption or other, if the insurer crafted the policy in a manner that excludes payment for BI or other losses.

- I absolutely DO want an P&C insurer who is sued for non-payment of a Business Interruption claim to fight the lawsuit all the way to our US Supreme Court.

- Fairness, from the perspective of an insurance company and the policies it sells, is a matter of paying ONLY those claims that meet the terms, conditions, and restrictions of the policy.

- It is completely unfair for politicians to ask or bully insurers to pay claims that the insurers should not contractually pay.

- I assume that going forward, after COVID-19 is resolved either by treatment or vaccine or both, that smart P&C insurers will list every virus, every pathogen, and every pandemic by name and associated characteristics that has appeared on the planet as a set of exclusions to Business Interruption coverage. I believe this is contractual over-kill but insurers must protect themselves from ‘adventuresome’ lawyers who make their living by finding gaps (where none really exist) in insurance contracts.

I want to add that I believe that insurance regulators in each State that P&C insurers sell Business Interruption coverage have a fiduciary responsibility to ensure that the P&C insurers do NOT pay pathogen related Business Interruption claims (if the policy states that BI is not covered). Any reinsurers involved with these policies also have a similar responsibility.

Primary P&C insurers, P&C reinsurers, and insurance regulators should take a very strong stand against paying pathogen related BI claims (if the policy excludes pathogens from triggering BI claims).

The history of our species is adaptation. This might last 12 months or 18 months. Whatever the timing until the “all clear” signal, we will as a society adapt and get through this global pandemic.