When insurers need to know about property risks

Note: I realize that the last time period in the list below could be wrong because I always get claims made versus claim occurrence mixed up. (I don’t know how to calculate IBNR either but I understand it requires a dark, stormy night, the entrails of a recently killed chicken, and a secret mantra.)

Insurance firms need to understand the specifics of a property – to better understand the current and emerging exposures to the property – throughout several time periods, specifically when:

- a client has requested the property to be insured

- the property is already insured

- the property has one or more claims against it throughout the time the carrier insures the property

- the client has moved to another insurance carrier but the prior carrier sold a contract with a claims occurrence clause (commercial property contracts).

Corporate risk managers (should) have the same interests understanding the (variety of exposures) to their employer’s commercial properties as insurance carrier underwriters and claim managers.

Current methods used to understand property risks

(Re)insurers – and (re) insurance brokers – can determine the specifics of a client’s properties by taking pictures of it (from the ground and/or a drone or both), from the completed policy application, from CLUE reports (for residential homes), from CoreLogic data, from local municipal records, and/or from real estate records or some combination of all of these sources. (I’m sure I am missing other sources that identify the essential characteristics of a property that a general contractor or architect would know throughout the construction process).

All of the above sources are really analog even if some of them could be put into a spreadsheet. It would be hard if not impossible to integrate all of the ‘data’ from two or more of these sources. It would definitely be impossible for a risk manager, marketing, underwriting, or claims professional to visually interact with the data (whether integrated together or not).

Don’t despair about primarily only having analog sources. A relatively new digital solution called Digital Twins, primarily used in the manufacturing industry, can be useful for P&C (re)insurers, (re)insurance brokers, and risk managers focused on property risks.

Note: You’ve probably figured out by now that I am mixing residential and commercial property together in my comments. The Digital Twins solution is applicable for each one. (Although it would have been better if I had focused on only one of them in the post. Mea culpa.)

What are Digital Twins?

Obviously, this brings up the question: What are digital twins?

This excerpt is taken directly from an article titled “ArcGIS: A Foundation for Digital Twins”, by Chris Andrews, ArcUser The Magazine for ESRI Software Users, Spring 2021:

“In the last several years, the convergence of geospatial technology, building information modeling (BIM), and interactive 3D has driven a conversation about digital twins and how they may be used to simulate single facilities [My own note: is your IoT antenna beginning to twitch a little bit?], entire cities, and even large natural systems. [My own note: Descartes Labs is building a digital twin of our planet. https://descarteslabs.com]

Digital twins are virtual representations of the real world including physical objects, processes, relationships, and behaviors.”

For me, Digital Twins provide a system of data characteristics that mirror a real-world entity. This digital ‘x-ray’ of as many components of the entity as possible that can be identified and modeled enables visual accessibility and manipulation.

Examples of Digital Twins

This post is about (re)insurers and brokers (and risk managers) using Digital Twin solutions to better understand the exposures of a residential home or a commercial property.

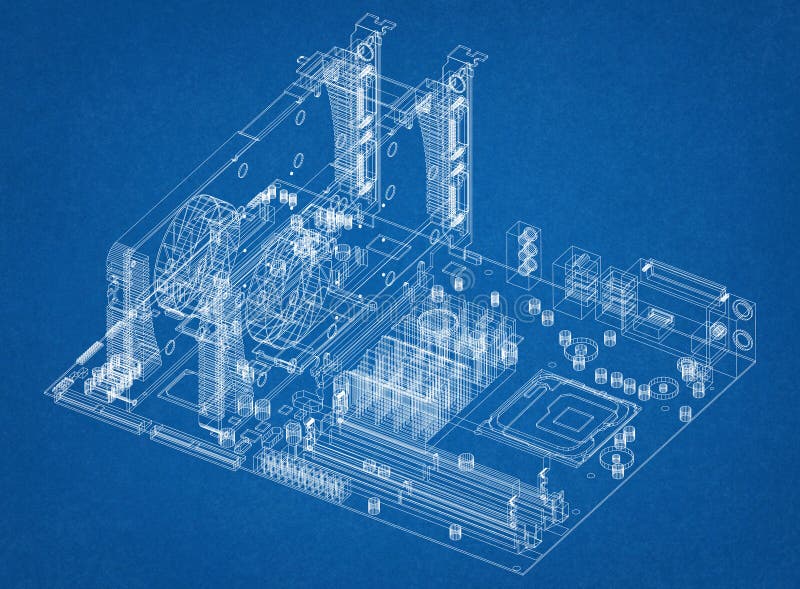

But there is no limit to what Digital Twins can mirror. You could create a Digital Twin of our planet (I mentioned that is an initiative that Descartes Labs is doing), of a city (as shown below to help build or expand the ‘smart city’), of a residential home or neighborhood, of a factory (also shown below), of a vehicle (shown below), or a jet engine (not shown).

All three images below are examples of Digital Twins from Bing. I found them by searching for Digital Twins or Digital Twins factories, vehicles, and cities.

So, what are Digital Twins, again?

Digital Twins are a comprehensive visual and interactive solution of a system of components (e.g. things), actually an ecosystem of components, that make up yet another ‘larger’ component. I mention ‘ecosystem of components’ because each component within a Digital Twin potentially impacts and can be impacted by one or more of the other components.

Behaviors of the various ‘things’ matter within a Digital Twin and of the Digital Twin itself (which is really one large ‘thing’).

One analytical path using a Digital Twin solution is to determine the behavior of any one component (whether new or changed in some manner), or a set of components, within the ‘larger’ component from the status or changes to any of the other components. As an example, a new building within a city could impact vehicular and pedestrian flow, wind flow around all the buildings and on the streets, and ability to timely deliver supplies to any of the existing buildings.

Enhancing Analysis of Digital Twins with IoT and Geospatial Data

IoT is critically important to analyze Digital Twins …

Digital Twins is, or should be, a well-orchestrated composition of ‘things.’ If the things in the Twin have web-connected sensors embedded within them or attached to them, then the composition becomes replete with IoTs and will behave more like a great musical masterpiece. Each IoT within the Twin could relate data to itself, to other IoTs within the Twin, and to the Twin as a coherent whole.

In truth, a robust IoT-enabled Digital Twin will behave more like a natural ecosystem. Users attempting to better understand the Twin (and therefore the actual physical object(s) in real life [thinking about Second Life redux now, you rascal?]) will be more able to interact with, and analyze the behaviors of, the Twin (or any of its IoT-enabled components).

… as is geospatial data

Knowing about each thing, or IoT, within the Digital Twin – and how their behaviors change (or don’t) subject to both internal and external forces is obviously critically important to understanding both the Twin and the object in real-life.

However, being able to augment geospatial information of where the Digital Twin is located or could transit through over time is also critically important. This becomes apparent when the user of the Twin augments characteristics of the geographic areas (in which the Twin is or is moving through), including (past, current, and forecasted) weather events (including hurricanes, tornadoes, or tsunamis), flooding, wild fires, sink-holes, mud slides, sand storms, or hail storms.

From the same ArcUser for ESRI article excerpted above:

“GIS can be used to create digital twins of the natural and built environment. It can also be used to integrate many different representations of the real world, virtual models of real-world assets, or natural systems along with information models, data, reports, analyses, and user experiences intended to capture the state of a digital twin, monitor its performance, and predict future outcomes using it.”

Digital Twins: An natural partner of AR and VR

You can see the innards of a Digital Twin. You should also be able to manipulate any of the components of the Twin (whether they are IoT-enabled or not) by touch. Perhaps not direct touch but hopefully by haptic feedback. Augmented Reality (AR) capabilities, possibly using mobile devices, should enable an immersive feel.

However, Virtual Reality (VR) replete with googles, gloves, and a joystick (for three-dimensional movement) should enable full immersion. “Walk” though the Digital Twin of the residential home or the factory properties. “See and Feel” the quality of the lumber, the fit of the framing, the wiring, the plumbing, the roof – including picking up the roofing materials, and the boiler and other machinery. Determine what happens to the commercial property or residential home when a hurricane occurs or when a hail storm hits in all of its fury. Experiment with ‘better’ building materials, better site location, or better location of any one or more pieces of equipment or appliances in the commercial property or residential home.

“Walk” through the smart city: do you see any problems with moving pedestrians from one point to a second point in the city? How much traffic – of whatever mix of transportation modes – might the city accommodate in the Twin? Where might healthcare provider clinics/hospitals be ‘best’ placed (and why)? What might be the best evacuation paths out of the city in the case of an emergency? Either VR or AR will help you get yourself immersed in the Twin to see, feel, walk, and manipulate the Digital Twin – but personally I would want to use VR.

Potential P&C insurance Digital Twin use cases

How can Digital Twins solutions be useful for P&C insurance firms and risk managers?

Specifically focusing on residential and/or commercial property, Digital Twin solutions can help P&C insurance firms and risk managers analyze (a few ideas off the top of my balding head):

- How one or more of the components of a property might cause a fire or otherwise damage the Twin itself

- Which components might fail or otherwise wear out (and when) and with what consequences

- How the roof, windows, or other components might react to hail storms, and what size hail falling at what speed – and from what direction – might damage the roof, windows, or other components (given the geographic placement of the Twin, taking topography and natural growth around the Twin into account)

- The ability of the property to withstand hurricanes or other wind storms (given the geographic placement of the Twin, taking topography and natural growth around the Twin into account)

- The impact of flooding on the Twin or any of its components (given the geographic placement of the Twin, taking topography and natural growth around the Twin into account)

- The cost of replacing or repairing damaged components of the property (given the cost of labor and materials in the jurisdiction the Twin is located)

- How much energy the property requires for minimal operation given the geographic placement of the Twin, taking topography and natural growth around the Twin into account

- How much water the property requires for minimal operation (excluding what the inhabitants of the property might require at a minimum) given the geographic placement of the Twin, taking topography and natural growth around the Twin into account.

Which insurance departments / functions might find Digital Twin solutions helpful?

There are several departments / functions within (re)insurance carriers that could find Digital Twin solutions helpful. These departments are focused on creating and/or underwriting new or enhancing existing property insurance policies (or bundled coverage policies that encompass property risks), pricing property coverage policies, including determining the assumption or ceding of reinsurance, determining target markets, and perhaps creating sales and distribution strategies for new or existing property policies.

Target P&C insurance firms for Digital Twins solutions

There are many P&C insurance firms that might benefit from the interactive analysis and use of Digital Twin solutions. This array includes reinsurance firms, reinsurance brokers (e.g. Guy Carpenter), primary insurers, and brokers. I also include Underwriting Labs in the target firms who could use Digital Twin solutions.

However, any (re)insurance firm or risk manager that wants to use Digital Twin solutions needs to have strong modeling capabilities, deep advanced analytical skills, and significant computing resources internally. Or the (re)insurance firm needs to be willing to purchase these resources, create them organically (e.g. training existing staff involved with quantitative analyses), or be willing to partner with firms that have one or more of these resources, preferably with knowledge of Digital Twin solutions.

Reaching out to non-insurance firms for help

Which (non-insurance) firms might (re)insurance firms and brokers (and risk managers) reach out to help with the creation, analyses, and use of Digital Twins?

My list, and I realize that I have probably left out several firms, includes (caveat: I don’t know which of any of these firms actually have Digital Twin solution experience):

- Technology firms like IBM, SAS, SAP, or Oracle

- Information firms like LexisNexis or CoreLogic

- Cloud firms like Amazon, Google, or Microsoft

- Industrial firms like GE,Siemens, Bosch, GM, BMW, Mercedes Benz, or Dassault Systemes

- Geospatial firms like ESRI.

(Re)insurance firms and risk managers may also want to reach out to management consulting firms such as McKinsey or BCG for guidance concerning how they might want to proceed from the idea of using Digital Twins to deployment of Digital Twins, analyses of Twins, and the myriad processes required throughout the use of Twins. [I didn’t include processes in my discussion of Digital Twins but they are as equally important as any element of an initiative to create and use Twins.]

What’s needed for (re)insurers, brokers, and risk managers going forward to use Digital Twins?

I suggest (re)insurance firms (carriers and brokers) and risk mangers:

- do some preliminary research of Digital Twins

- talk to their colleagues in other insurance firms as well as any colleagues they have in manufacturing firms

- sketch some ideas of how their firm could use Digital Twins

- think about the resources they would need

- do a cost/benefit analysis

- reach out to one of the firms listed above with ideas and questions.